Offshore Wind in South Korea: state of affairs as of June 2024

Released on 31 May 31 2024, South Korea's draft 11th Basic Plan targets 14.3 GW offshore wind by 2030 and 40.7 GW total wind by 2038. The 2024 elections highlight a renewable shift, with strategies to strengthen the supply chain.

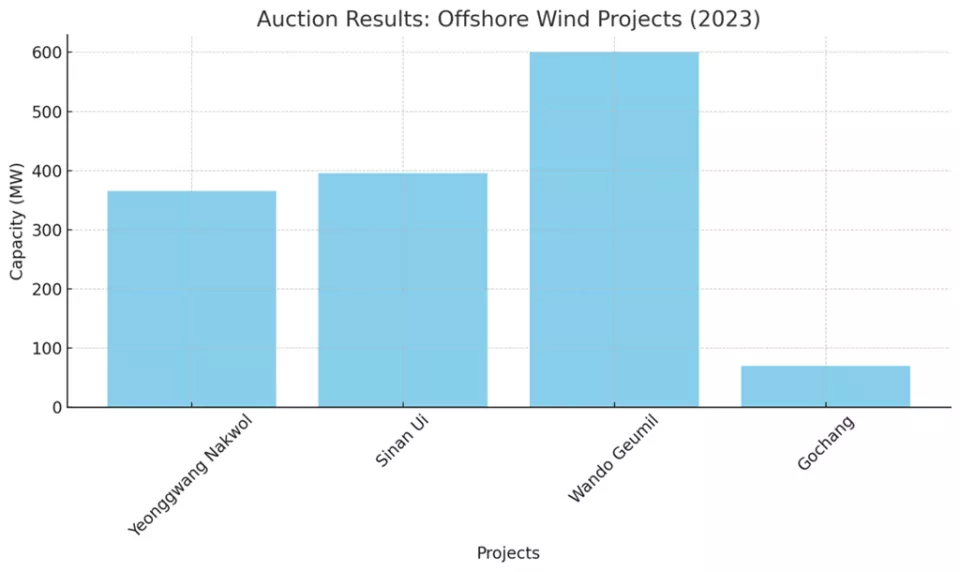

2023 Auction Results

The 2023 auction saw the allocation of 1.431 GW of offshore wind capacity across four major projects:

- Yeonggwang Nakwol Project: 365 MW using 5.7 MW Vensys (Goldwind) turbines.

(Myungwoon Industrial Development)

- Sinan Ui Project: 396 MW utilising 15 MW Vestas turbines.

(KOEN, Hanwha E&C, SK D&D)

- Wando Geumil Project: 600 MW also with 15 MW Vestas turbines.

(KOEN, Yunglim Industry)

- Gochang Project: 70 MW employing 6.0 MW Mingyang turbines.

(Dongchon Wind Power)

The auction focused on bid prices, with the ceiling price kept confidential to reduce costs. Two projects incorporated Chinese wind turbine generators, raising concerns about Chinese influence in the Korean offshore wind sector. In January 2024, there were 83 offshore wind projects with an EBL (Electric Business License) corresponding to 28 GW.

Political Landscape and Energy Policy Implications

The 2024 parliamentary elections, held on April 10, 2024, have reshuffled the National Assembly, transforming South Korea’s energy policies.

- The Democratic Party (DP) advocates for the '3540 Plan’, aiming for 40% renewable energy by 2035, and emphasises fast-tracking offshore wind power deployment and supporting RE100.

- The People Power Party (PPP) focuses on a balanced energy mix, including nuclear and renewables, regulatory reforms, and leading the hydrogen economy.

Draft 11th Basic Plan for Electricity Supply and Demand (2024-2038)

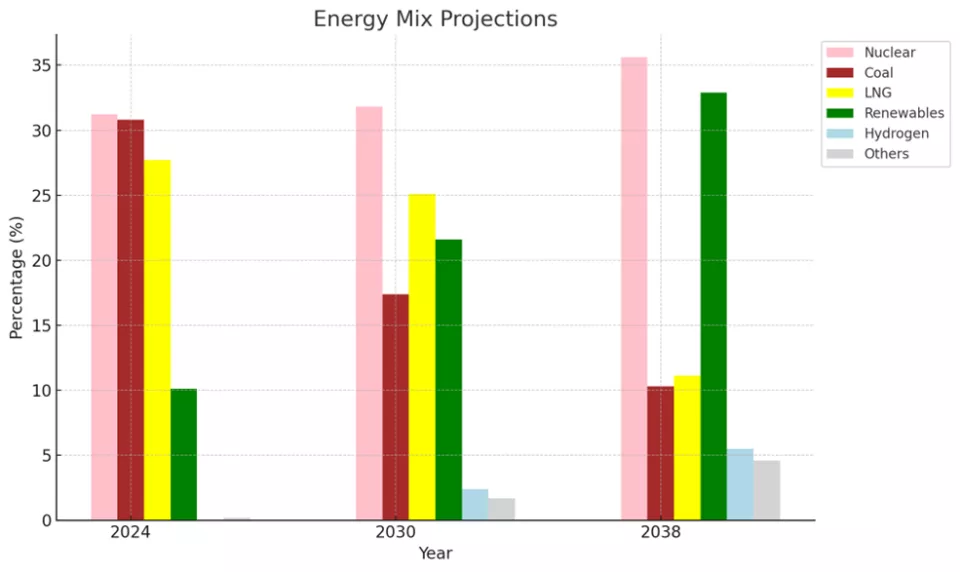

Announced on 31 May 2024, this draft outlines South Korea's long-term electricity supply and demand strategy. By 2030, the plan targets 72 GW of solar and wind power. By 2038, the plan aims for 120 GW of renewable energy, including 40.7 GW of wind and 74.8 GW of solar.

The plan also anticipates constructing three new nuclear power plants and one small modular reactor (SMR), contributing to a goal of 70% carbon-free power generation by 2038.

Strategic Directions and Domestic Supply Chain Enhancement

To address delays in permits, declining community acceptance, and grid saturation, the Ministry of Trade, Industry, and Energy (MOTIE) published a comprehensive strategy on May 16, 2024. This strategy includes a government-led push to achieve a 6 GW annual increase in renewable energy, enhancing the entire offshore wind ecosystem.

The plan focuses on manufacturing, installation, and financing, and adapting the renewable energy market to support rising demand. Additionally, it provides for building the necessary infrastructure such as ports and ships and establishing a robust financial support system, with 1.2 trillion won allocated in 2024 and 9 trillion won by 2030.

Strategy to Strengthen the Supply chain?

To strengthen the domestic supply chain for offshore wind, the proposed strategy includes improving competitiveness across the entire offshore wind ecosystem, enhancing the evaluation system for competitive-bidding auctions, supporting the construction of necessary infrastructure such as ports and ships, and establishing a robust financial support system.

This involves enhancing the evaluation system such as technology transfer and job creation, rather than implementing explicit local content requirements. This approach aims to counter the competitive pricing of Chinese turbines, which are currently 30% cheaper, making it difficult to compete solely on price. A roadmap covering bid volumes, timing, and evaluation criteria will be announced in July 2024.

What is Next?

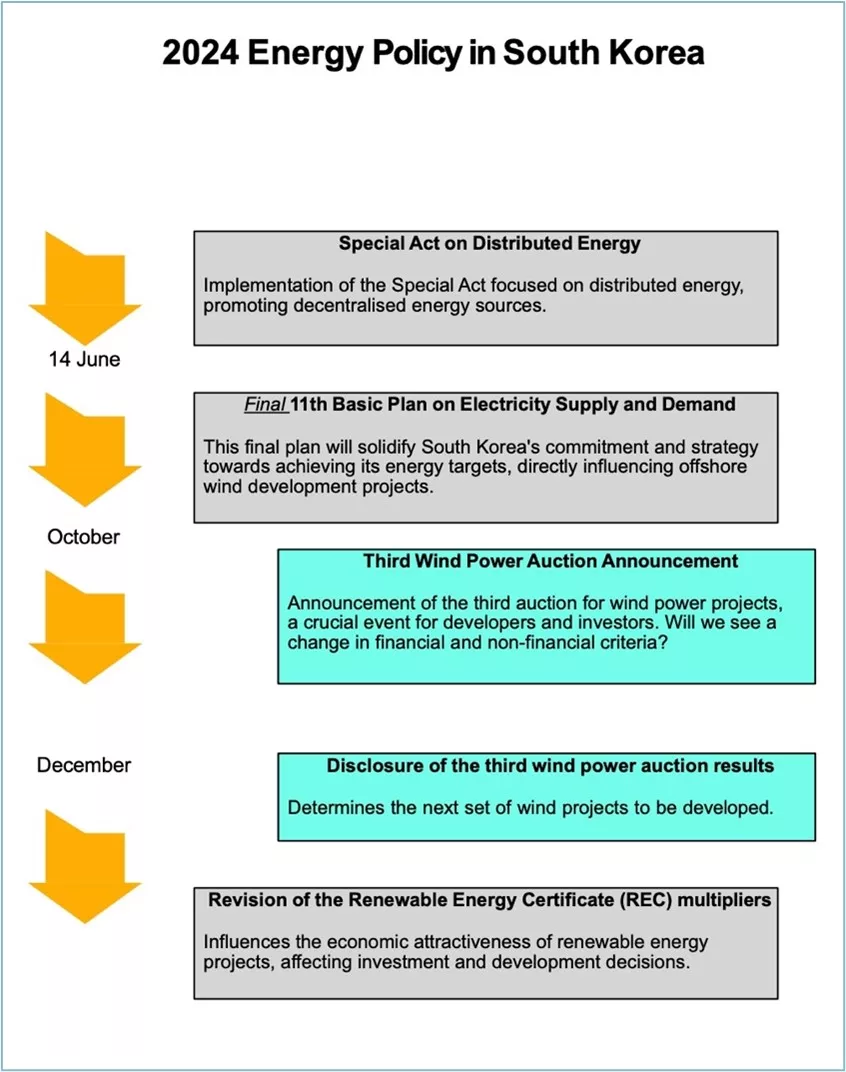

The Special Offshore Wind Act and the Special Act on the Expansion of the Power Grid are expected to be re-introduced in the 22nd National Assembly. Both acts expand the role of the government, which is needed for streamlining permitting procedures and necessary grid expansion. Endorsement of both acts is required to accelerate to the 14.3 GW offshore wind target by 2030.

This week, the Special Act on Promotion of Distributed Energy’will come into effect. The purpose of this special act is to contribute to the development of the domestic economy by activating distributed energy through the use of new technologies and increasing the stability of energy supply and demand.

The Distributed Energy Act introduces the requirement for a power grid impact assessment to ensure that new and increased electricity usage does not negatively affect the power grid’s stability and reliability. This measure is crucial for maintaining a robust and efficient energy infrastructure, particularly as more distributed energy sources are being integrated.

Overall, the mandatory installation of distributed energy systems under the Distributed Energy Act is a significant step towards a more sustainable and resilient energy infrastructure in South Korea.

Copyright

This short market update was drawn up by Erik Roelans on behalf of Blue Cluster on 13 June 2024.

All rights reserved. Any reproduction, duplication or use of this material without prior permission from Blue Cluster is strictly prohibited.